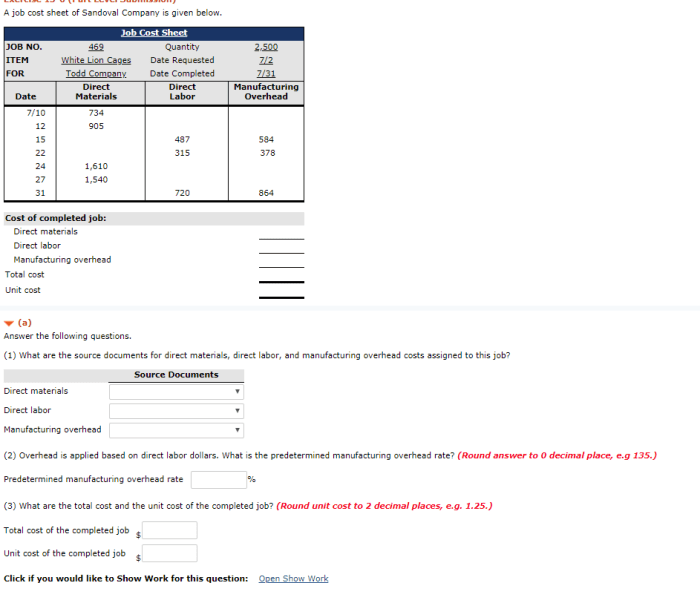

A job cost sheet of Sandoval Company is given below. A job cost sheet is a detailed accounting document that provides a summary of the costs associated with a specific job or project. It is an essential tool for businesses that need to track the costs of their jobs and ensure that they are profitable.

This guide will provide a detailed explanation of the job cost sheet of Sandoval Company. We will discuss the purpose and significance of a job cost sheet, as well as the different types of costs that are included on the sheet.

We will also explain how to calculate direct material costs, direct labor costs, and manufacturing overhead costs. Finally, we will discuss how job cost sheets can be used for decision-making.

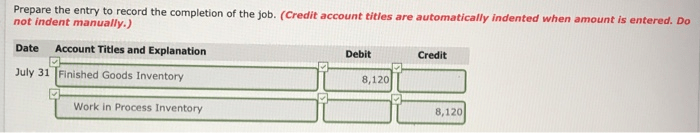

Job Cost Sheet Analysis

A job cost sheet is a document that accumulates the costs associated with a specific job or project. It is used to track the direct material costs, direct labor costs, and manufacturing overhead costs incurred during the production process.

The job cost sheet of Sandoval Company provides a detailed breakdown of the costs incurred for a particular job. It includes information such as the job number, customer name, date, and a list of the materials, labor, and overhead costs incurred.

Direct Material Costs

- Direct material costs are the costs of the materials that are directly used in the production of a product.

- These costs can be calculated using various methods, such as the weighted average method or the first-in, first-out (FIFO) method.

Direct Labor Costs

- Direct labor costs are the wages and benefits paid to employees who are directly involved in the production of a product.

- These costs are typically calculated by multiplying the number of hours worked by the hourly wage rate.

Manufacturing Overhead Costs

Manufacturing overhead costs are the indirect costs that are incurred in the production of a product, such as rent, utilities, and depreciation.

- These costs are allocated to jobs using various methods, such as the activity-based costing method or the traditional costing method.

Job Costing Methods, A job cost sheet of sandoval company is given below

There are two main job costing methods: actual costing and normal costing.

- Actual costing uses actual costs incurred during the production process, while normal costing uses predetermined overhead rates.

- Each method has its own advantages and disadvantages, and the choice of method depends on the specific needs of the company.

Job Cost Sheet Analysis for Decision-Making

Job cost sheets can be used for various decision-making purposes, such as:

- Cost control: By analyzing job cost sheets, companies can identify areas where costs can be reduced.

- Profitability analysis: Job cost sheets can be used to determine the profitability of specific jobs or products.

- Pricing decisions: Job cost sheets can be used to set prices for products and services.

Q&A: A Job Cost Sheet Of Sandoval Company Is Given Below

What is the purpose of a job cost sheet?

A job cost sheet is used to track the costs associated with a specific job or project. It provides a detailed accounting of all direct and indirect costs incurred during the production process.

What are the different types of costs that are included on a job cost sheet?

The different types of costs that are included on a job cost sheet include direct material costs, direct labor costs, and manufacturing overhead costs.

How are direct material costs calculated?

Direct material costs are calculated by multiplying the quantity of materials used by the unit cost of the materials.

How are direct labor costs calculated?

Direct labor costs are calculated by multiplying the number of hours worked by the hourly wage rate of the workers.

How are manufacturing overhead costs allocated to jobs?

Manufacturing overhead costs are allocated to jobs using a variety of methods, such as the direct labor hour method, the machine hour method, and the activity-based costing method.